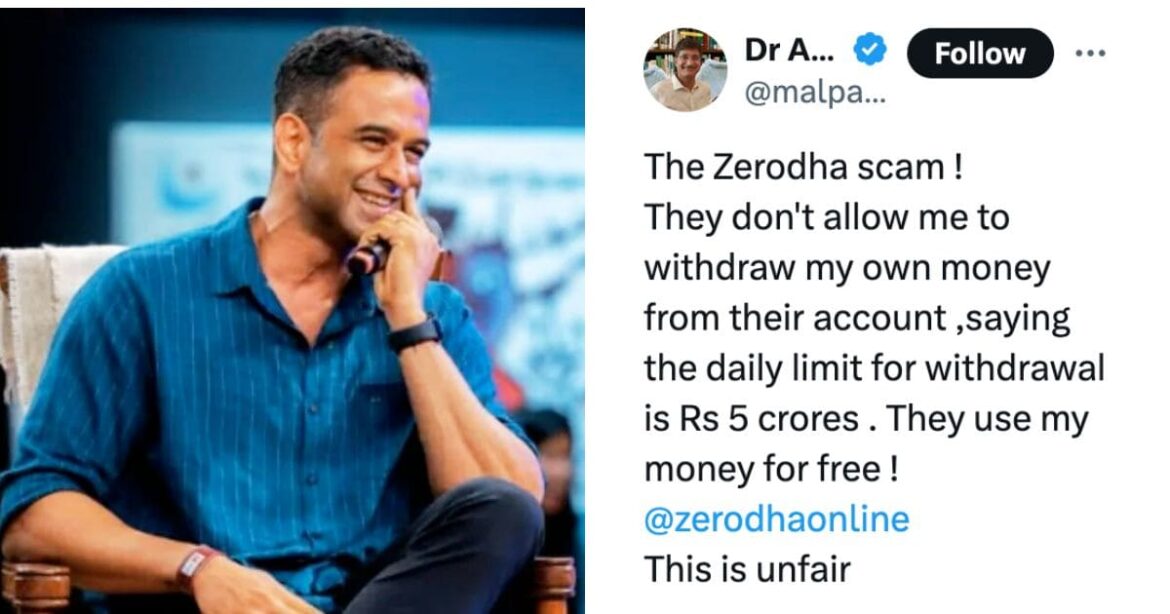

A heated debate broke out on social media after well-known investor and IVF specialist Dr. Anirudh Malpani accused Zerodha, India’s largest stock brokerage platform, of stopping him from withdrawing his own money. His post quickly went viral, especially among traders and long-term investors who follow stock market updates closely. The situation became even more interesting when Zerodha co-founder Nithin Kamath personally stepped in to clarify the matter.

What Exactly Happened?

Dr. Malpani shared on social media that although he had over ₹18 crore withdrawable balance in his Zerodha account, the platform only allowed him to take out ₹5 crore per day. He called this limit “unfair” and even went so far as to call it a “scam.”

Along with his post, he attached screenshots showing:

- Account value of around ₹42.92 crore

- Used margin of about ₹24.46 crore

- Withdrawable balance of ₹18.46 crore

In his words:

“The Zerodha scam! They don’t allow me to withdraw my own money. Daily limit is ₹5 crores. They are using my money for free.”

This message instantly spread across investor communities, WhatsApp trading groups, Twitter/X, and finance forums.

Zerodha Responds With Clarification

Zerodha’s support team replied to him publicly.

They explained that withdrawals above ₹5 crore are not blocked, but require a support ticket for security verification.

Their reasoning was simple:

- Large money transfers need extra approval.

- Once funds are released, there is no way to reverse them if a mistake occurs.

They confirmed that this is a standard security practice, not a restriction on his funds.

However, Dr. Malpani replied saying he had already raised a support ticket, and even shared proof. Zerodha then confirmed the request was under review and would be processed soon.

Nithin Kamath Steps In to Clear the Air

Seeing the discussion growing online, Zerodha’s co-founder Nithin Kamath addressed the matter himself. In a calm and clear explanation, he stated:

“Hi Doctor, your payment requests were processed yesterday. We need to ensure we have certain checks in place when clients withdraw funds. A ₹5 crore limit is the threshold where we ask customers to raise support tickets.”

He further explained:

- The limit is for safety, not to block access.

- Large withdrawals can sometimes involve banking delays, technical risks, or human errors.

- The system needs to protect both the platform and the customer.

Kamath emphasized that this is not a scam, and in fact, the payouts were already being processed.

Why Does This Limit Exist?

Many financial experts, including traders and fintech analysts, later supported Zerodha’s clarification online. They pointed out that:

Every financial platform — banks, stock brokers, trading apps — follows certain withdrawal and transfer limits for security.

These measures help prevent:

- Fraud

- Accidental transfers

- Hacking cases

- System failure risks

In simple words:

If something goes wrong with a large transfer, the money is almost impossible to get back.

So such checks act as safety layers.

This Is Not Just About Zerodha — It’s Industry Standard

Many people don’t know this, but:

- Banks also have daily RTGS/NEFT/IMPS limits.

- Real estate and investment funds also require documentation before large withdrawals.

- Even UPI transactions have limits per day for safety.

So Zerodha’s policy is not unusual.

What makes this incident go viral is that the amount involved was very large, which created natural curiosity among people.

Why This Story Matters to Indian Investors

Zerodha is one of the most trusted brokers in India with over 1.5 crore users. So when a big investor accuses the company publicly, naturally many traders get concerned.

However, this incident highlights a few important lessons:

1. Withdrawal Limits Are Not Always a Bad Thing

They protect investors from:

- Unauthorized access

- Mistakes in large fund transfers

- Fraud & hacking attempts

2. Communication Matters

If investors do not fully understand platform policies, confusion can happen — which is why clear communication is key.

3. Social Media Can Amplify Issues

One post can spark nationwide debate instantly. But it also helps companies respond transparently.

Public Opinion: Mixed but Mostly Supportive of Zerodha

Many netizens and market experts came forward saying:

- Zerodha’s policies are transparent.

- The process is fair.

- This is a security protocol, not wrongdoing.

Some users commented that having ₹18+ crore in a trading account itself shows trust in Zerodha.

A few others felt Zerodha should pre-inform users more clearly about withdrawal limits in the app UI, to prevent confusion.

Final Thoughts

The controversy ended with clarity:

Zerodha did not block Dr. Malpani’s money, and the ₹5 crore limit is simply a security checkpoint for very large withdrawals.

Once verification is completed, the funds are released.

This incident shows how:

- Transparency

- Quick official response

- And clear customer communication

- are essential for maintaining trust in India’s fast-growing digital financial ecosystem.

For regular investors, this story is a reminder to always understand withdrawal rules, just like we check brokerage charges and margin conditions.