For Indian investors, safety of money is always the first priority. Many people are not comfortable with stock market or risky schemes. In this situation, the Life Insurance Corporation of India (LIC) has introduced a fixed deposit (FD) scheme that promises regular monthly income along with full safety of capital.

According to the details, this plan is offered through LIC Housing Finance Limited and is designed especially for small investors, retirees, and anyone who wants a fixed monthly return.

What is LIC FD Yojana?

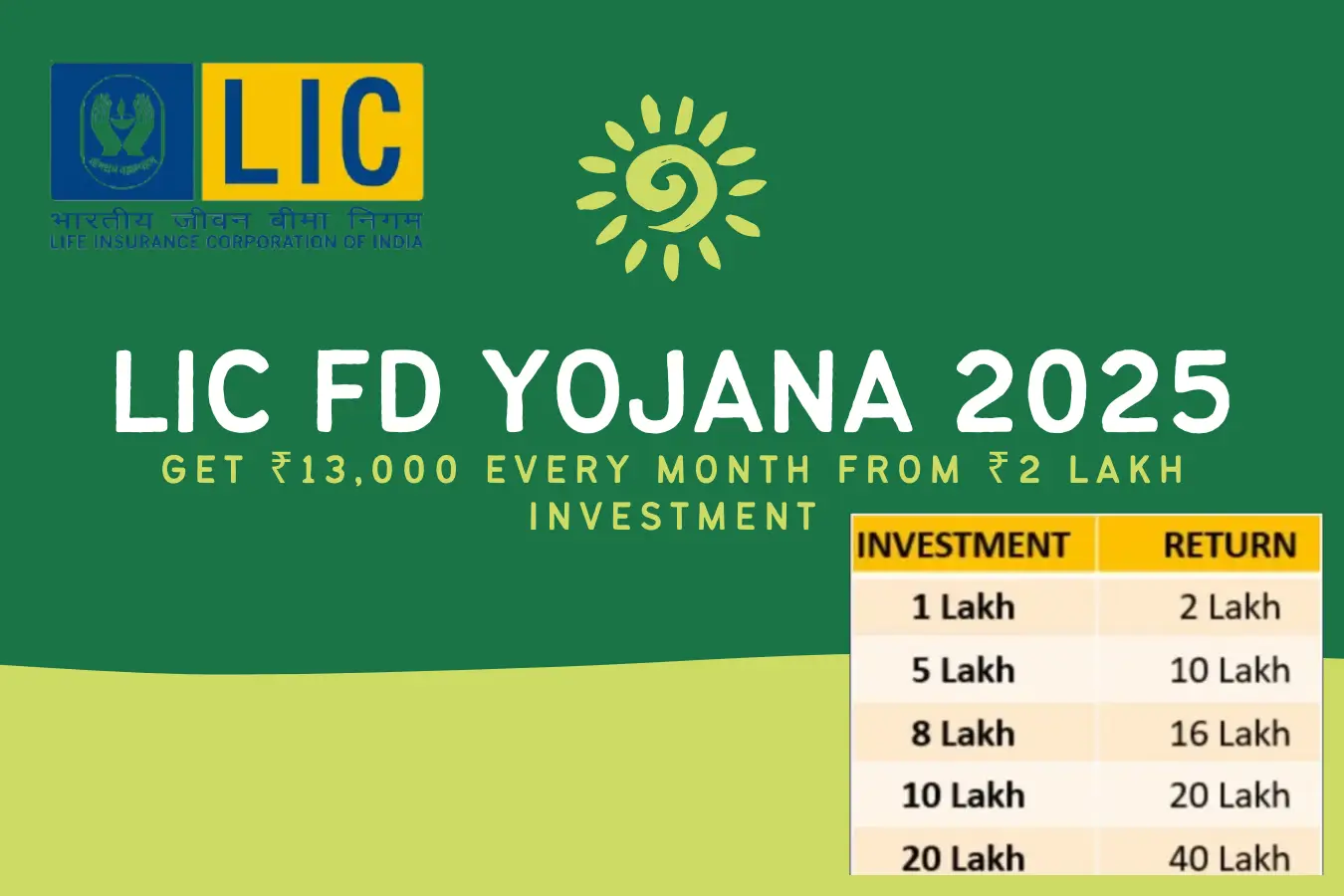

LIC FD Yojana is a monthly income fixed deposit plan where investors can deposit a minimum of ₹2 lakh. In return, they receive guaranteed interest every month directly in their bank account. The interest is paid either through electronic transfer or warrant system. This FD works like a normal bank deposit but comes with the trust of LIC and attractive interest rates.

Read More: Berojgari Bhatta Yojana 2025: ₹2500 Monthly Allowance for Unemployed Youth

Interest Rates and Returns

Currently, the scheme offers interest rates between 7.25% to 7.75% per year. Senior citizens get an extra 0.25% interest.

To understand clearly:

- On ₹2 lakh deposit at 7.75% annual rate, the investor will earn about ₹15,500 in one year.

- That means, every month, around ₹1,291 will be credited to the investor’s account.

Some advertisements claim higher returns, but investors should carefully read the terms before investing.

Who Should Invest in This FD?

This scheme is most useful for:

- Retired people who want regular monthly income.

- Small investors who don’t want to take stock market risks.

- Families looking for a safe deposit option with good interest.

- People who want the facility of loan against FD in case of emergency.

Key Benefits of LIC FD Yojana

- Fixed and guaranteed monthly income.

- Extra benefit for senior citizens.

- Loan facility up to 75% of deposit amount.

- Flexible tenure from 3 months to 20 years.

- Premature withdrawal possible with a small penalty.

- Safe and trusted option compared to risky investments.

Documents Required for Application

To open an FD account, applicants need to provide:

- Filled application form with signature.

- PAN card copy.

- Aadhaar card, passport, driving licence or voter ID as identity proof.

- Address proof like electricity bill, ration card, etc.

- Two passport size photos.

- Age proof for senior citizen benefit.

Joint accounts can also be opened with documents of all depositors.

How to Apply?

Interested investors can apply in three ways:

- By visiting the nearest LIC branch office.

- Through the official LIC Housing Finance website.

- By contacting any authorised LIC agent.

After submitting the form, documents and deposit amount, the FD account gets activated and monthly interest starts coming.

Expert Opinion

Financial experts suggest that this FD plan is best for people who want security and monthly income. However, investors should keep in mind that returns are not very high compared to other investment options like mutual funds or equity. But in terms of safety, trust and regular cash flow, this scheme is a reliable option.

Read More: PM Jan Dhan Yojana 2025

Conclusion

The LIC FD Yojana 2025 is a strong option for those who want a risk-free monthly income source. With a minimum investment of ₹2 lakh, investors can enjoy assured returns, loan facility, and flexibility of tenure. While the monthly income is not very high, it provides financial stability and peace of mind, especially for senior citizens and conservative investors.

If you are looking for a trusted place to park your money and receive regular income, this LIC FD scheme can be the right choice.

FAQs

What is the minimum investment required in LIC FD Yojana?

The minimum amount is ₹2 lakh.

How much monthly return can I get from ₹2 lakh?

At 7.75% annual rate, you will get around ₹1,291 every month.

Can senior citizens get extra benefits?

Yes, senior citizens get 0.25% extra interest.

Is premature withdrawal allowed in LIC FD?

Yes, but a 2% interest penalty is charged if withdrawn before maturity.

Can I take a loan against this FD?

Yes, you can take up to 75% loan against the deposit amount.

Is this FD scheme safe?

Yes, it is backed by LIC Housing Finance Limited, which is one of the most trusted financial institutions in India.